Crude Oil

Hedge your volatile crude oil prices for a stable budget

Crude oil represents a fundamental asset in energy and manufacturing, serving as the base for numerous products in transportation, industry, and beyond. Given its role as a global commodity, crude oil is subject to extensive trading, with prices frequently impacted by shifts in geopolitical tensions, supply constraints, and market demand.

Refined from crude oil are products like gasoline, diesel, and other fuels, making it essential for companies with oil exposure to manage their price risk effectively. The unpredictable nature of crude oil prices can present a significant budgetary challenge, leading to volatility that directly affects operational costs.

Whether operating as an oil refiner, fuel distributor, or in heavy industry, GRM provides comprehensive risk management solutions customised to mitigate price fluctuations and safeguard your budget from unforeseen spikes.

Stay Ahead of the Curve with GRM Market Insights

In the fast-paced world of energy trading, knowledge is power!

Our Market Insights give you the edge with analysis and expert forecasts.

Hedging is a plan for financial stability

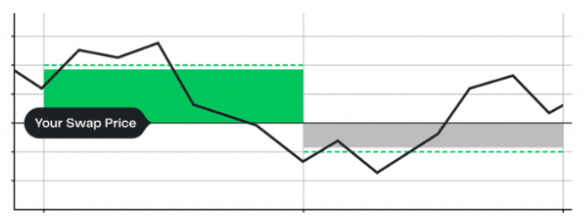

Effective hedging strategies offer a robust method for mitigating the risks associated with the fluctuating prices of crude oil. Through hedging, businesses can take strategic positions to offset potential losses, securing financial stability amidst volatile market conditions. For example, an oil refiner concerned about price increases might enter into financial arrangements that benefit from upward price movements, helping to neutralise the risk and achieve a more predictable cost structure.

Risk management with GRM

Our role is to empower companies across the oil sector to not only understand but strategically navigate the variables that impact crude oil markets. By collaborating with GRM, clients gain access to our expertise and market insights, enabling them to operate with greater confidence and financial predictability.