Call Options

What is a Call Option?

Call Options serve as a financial safeguard in energy markets, allowing businesses to protect themselves against rising prices. When a company purchases a Call Option, they gain the right to buy a specific amount of energy (such as oil, natural gas, or electricity) at a set price, called the strike price, before a certain date.

This tool is particularly valuable for energy consumers, such as manufacturers or transportation companies, whose profitability can be severely impacted by sudden spikes in energy costs. By using Call Options, these businesses can effectively set a ceiling on their energy expenses, ensuring more predictable operational costs.

For example, an airline might purchase Call Options on jet fuel to guard against potential price increases during peak travel seasons. If fuel prices rise above the strike price, the airline can exercise its option to buy at the lower, predetermined rate. If prices stay low, the airline simply lets the option expire, having only paid the initial premium.

Does your company need energy hedging?

Here are 4 reasons you do!

- Protect from unexpected changes

- Budget & contract security

- Focus on your core business

- Shine in front of stakeholders

Call Options vs. Put Options

- Call Options: These give the holder the right, but not the obligation, to buy an asset at a predetermined price (the strike price) within a specified period. Call Options are typically used to hedge against or speculate on an increase in the asset’s price.

- Put Options: In contrast, Put Options provide the right, but not the obligation, to sell an asset at a predetermined price within a specified period. They are generally used to hedge against or speculate on a decrease in the asset’s price.

The strategic use of Call Options can protect against upside risks, while Put Options can protect against downside risks, offering a balanced approach to managing energy price volatility.

How Call Options work in energy trading

The energy market is known for its significant price fluctuations, driven by factors such as geopolitical tensions, natural disasters, and changes in environmental policies.

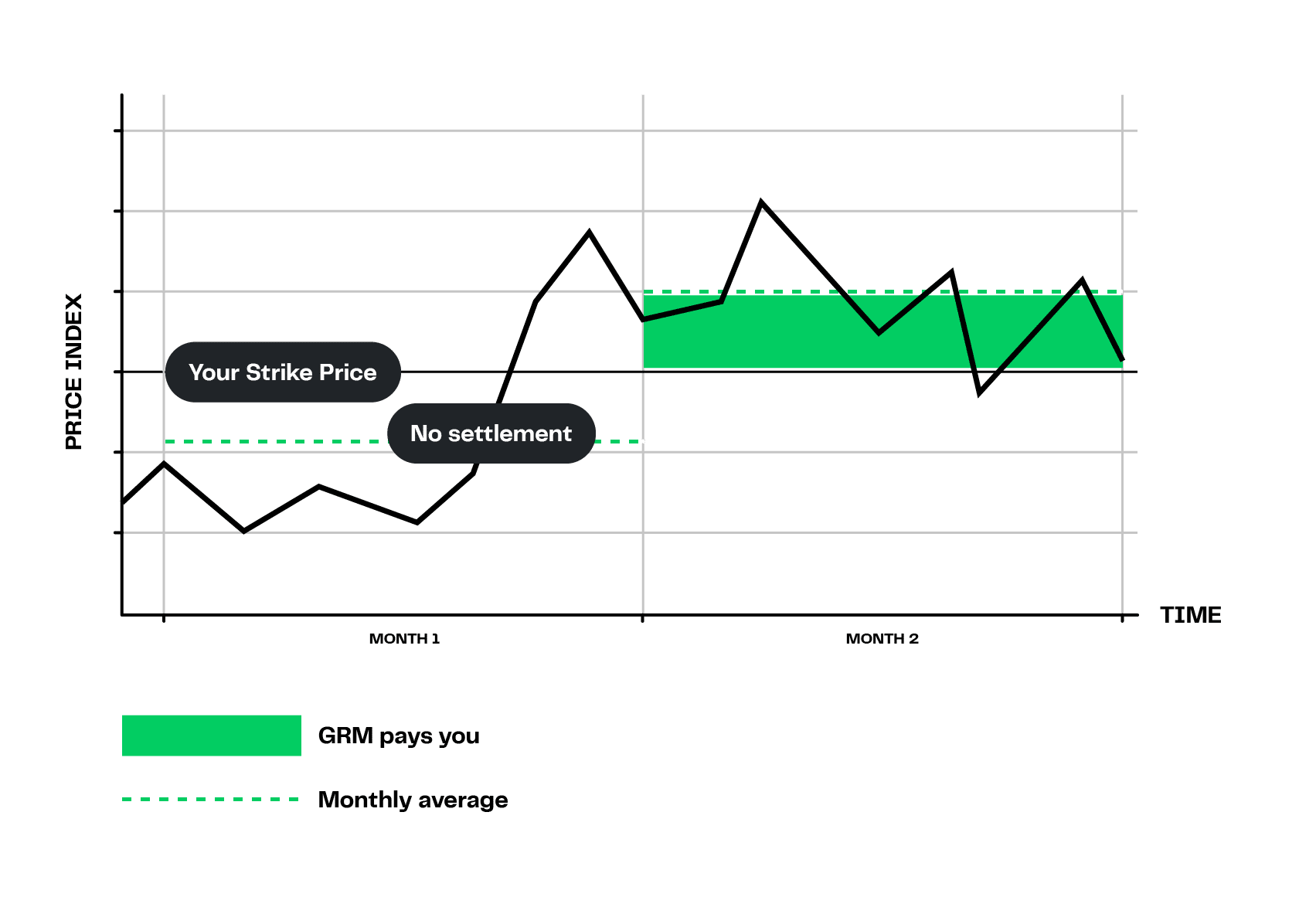

Call Options serve as a valuable hedging tool in this context. For instance, an energy consumer anticipating a rise in the price of natural gas might purchase a Call Option.

If the market price rises, the consumer can buy the gas at the lower, predetermined strike price, thus mitigating increased costs.

Conversely, if prices fall or remain stable, the only loss incurred is the premium paid for the option.

This asymmetrical risk profile – where the potential savings can significantly outweigh the losses – makes Call Options particularly attractive in the energy sector.

Call Options can provide a safety net against adverse market movements by securing a maximum purchase price, enabling more stable financial planning and budgeting for energy-intensive businesses.

Premium pricing and influencing factors

The cost of purchasing a call option, known as the premium, is influenced by several factors.

- Intrinsic value: This is the difference between the current market price and the strike price, if positive. As market prices rise above the strike price, the Call Option’s premium increases.

- Time value: Longer periods until expiration typically result in higher premiums, as there’s more time for favorable price movements.

- Market volatility: In the often turbulent energy markets, higher volatility tends to increase Call Option premiums due to the greater potential for price spikes.

- Supply and demand dynamics: Factors like geopolitical events, weather patterns, or technological advancements can shift energy demand, influencing option prices.

- Seasonal factors: Energy commodities often experience seasonal price fluctuations, affecting Call Option premiums accordingly.

Understanding these factors is essential for energy consumers and traders to effectively evaluate and utilise Call Options in their risk management strategies.

Stay Ahead of the Curve with

GRM Market Insights

In the fast-paced world of energy trading, knowledge is power!

Our Market Insights give you the edge with analysis and expert forecasts.