Aviation Fuel

Hedge your volatile aviation fuel prices for a stable budget

Aviation fuel not only constitutes a significant operational cost but also represents a critical component in ensuring performance and economic safety.

Jet A1 fuel, a type of kerosene, is essential for various aircraft, including helicopters, turboprops, and jets. Its composition meets strict standards for optimal engine performance in diverse conditions. Traded globally, its prices are often linked to specific indices and fluctuate based on the shifting balance of supply and demand. For aviation companies, this means fuel costs can be both significant and unpredictable.

Whether an airline is active in scheduled service, touristic operation or otherwise, we have longstanding experience in customizing risk management solutions under careful consideration of the company’s specific operation and surrounding factors.

This ensures a safer environment in an industry that requires detailed focus on financial performance.

Stay Ahead of the Curve with GRM Market Insights

In the fast-paced world of energy trading, knowledge is power!

Our Market Insights give you the edge with analysis and expert forecasts.

Hedging is a plan for financial stability

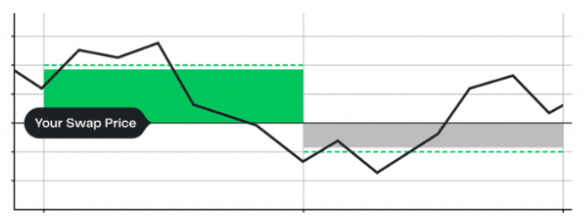

Beyond futures, hedging strategies offer a sophisticated means to counterbalance the risks associated with volatile fuel prices. Through hedging, aviation companies can take up financial positions that offset potential losses due to unfavorable price movements in the physical fuel market. For instance, if an airline anticipates a rise in fuel prices, it might opt to enter a financial arrangement that benefits from this increase, effectively neutralising the risk.

Risk management with GRM

Our role is to empower aviation companies not just to understand but strategically navigate the market variables that influence the volatile market of aviation fuel. By collaborating with GRM, aviation entities gain access to deep expertise and strategic insights, allowing them to manoeuvre through the market’s volatility with greater confidence and financial predictability.